NEW: BrowserGrow.com is now available!

AI agents to grow your business & do your marketing on autopilot in your browser

NEW: BrowserGrow.com is now available!

AI agents to grow your business & do your marketing on autopilot in your browser

NEW: BrowserGrow.com is now available!

AI agents to grow your business & do your marketing on autopilot in your browser

NEW: BrowserGrow.com is now available!

AI agents to grow your business & do your marketing on autopilot in your browser

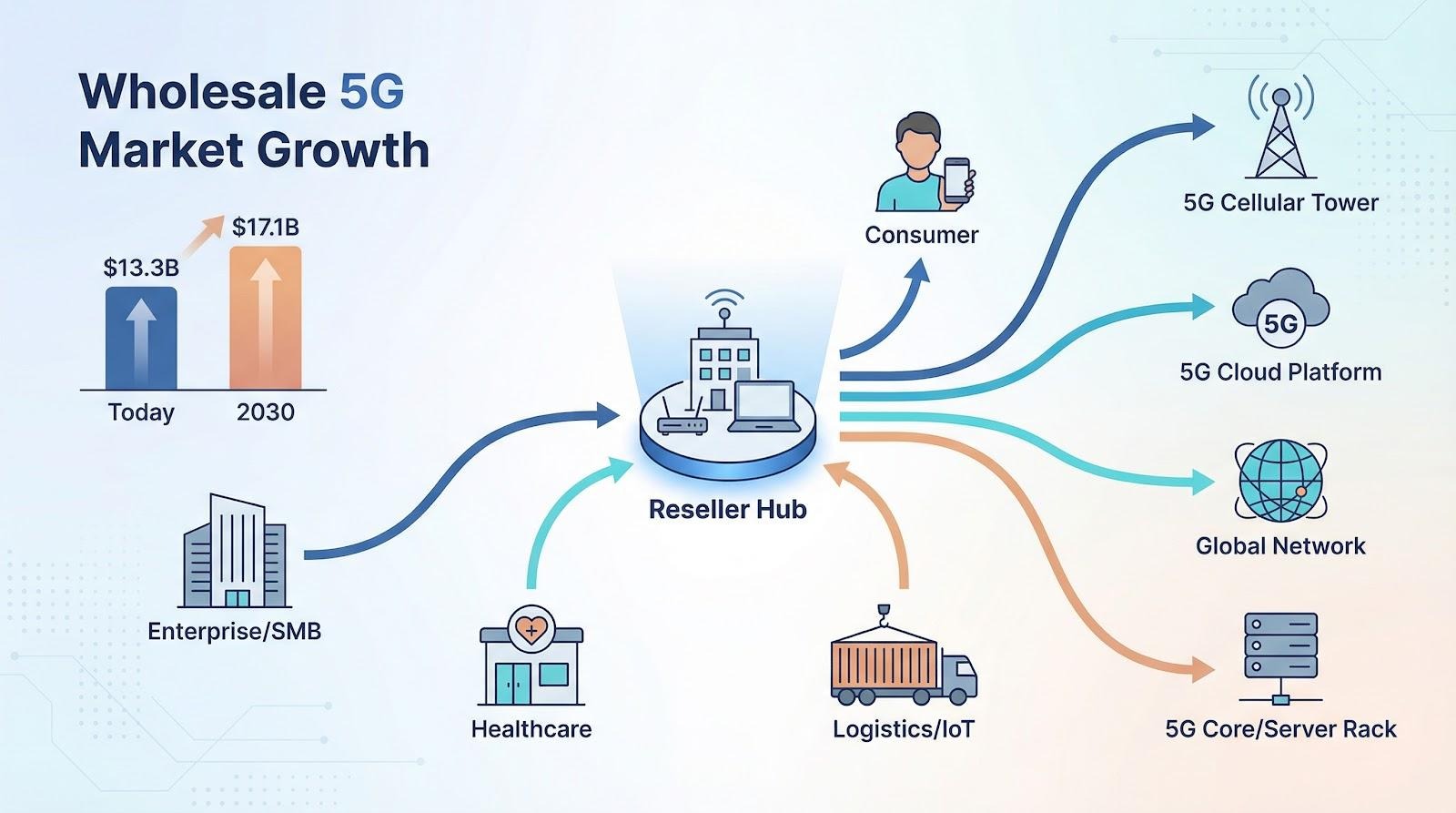

Wholesale 5G is a growing market where resellers act as a hub, matching each customer to the right network

Verizon’s 5G Ultra Wideband now reaches about 200 million people nationwide, according to a Verizon announcement. Low-band 5G and LTE fill in the rest of the map. As a wholesale partner, you can operate as a full MVNO: own plan design, billing, and frontline support while tapping Verizon APIs for real-time provisioning, policy control, and eSIM delivery.

Hardware support is built in; phones, C-band routers, and scanners ship from one catalog and can be financed inside the same portal.

The trade-off is cost. Verizon’s wholesale rates and minimum-subscriber targets sit near the top of the market, so arrive with a sharp go-to-market plan and a staffed support desk.

Best fit: healthcare telemetry, financial edge nodes, or any workload that cannot tolerate downtime. Price your offer at a premium, back it with Verizon’s RootMetrics-rated reliability, and defend churn with tight SLAs.

T-Mobile reports its Ultra Capacity 5G now reaches more than 330 million people, about 98 percent of the United States. Because the network already runs on a standalone 5G core, latency for gaming and AR training stays lower than on NSA networks.

Wholesale options stay flexible: launch as a full MVNO, a branded reseller, or a fixed-wireless broadband partner. Competitive rates and modest volume thresholds help smaller players get in without heavy upfront risk, especially if you start with an aggregator rather than going direct. Program overviews for connectivity marketplaces such as TD SYNNEX's ConnectSolv describe three common routes to market for partners: value-added reseller, referral agent, and co-selling motions, each with different expectations around who owns billing, support, and field services.

If you serve very remote pockets, keep a fallback eSIM profile from another network to hedge coverage gaps.

Best fit: high-volume consumer plans, budget-savvy SMB bundles, or IoT fleets that burn data across large territories and benefit from rapid plan experiments.

AT&T reports that its low-band 5G reaches about 320 million people, and its faster 5G+ mid-band layer now covers roughly 295 million. On the wireline side, AT&T Fiber passes 30 million locations today and is targeting 60 million by 2030.

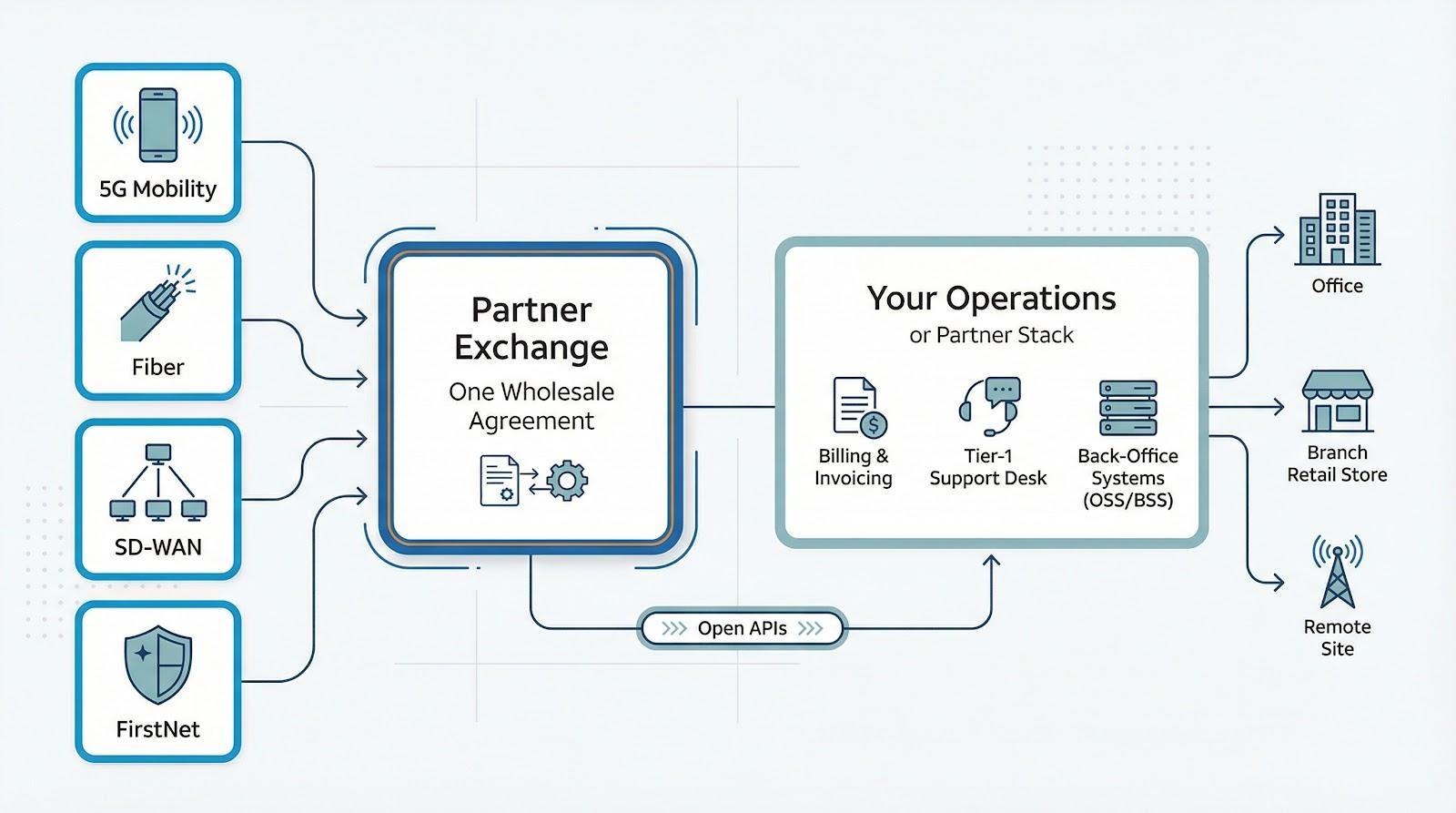

Through Partner Exchange you can bundle mobile, fiber, SD-WAN, and FirstNet under a single wholesale agreement. You set retail pricing, own billing, and keep the customer relationship, while open APIs sync orders and usage with your back-office stack.

AT&T Partner Exchange consolidates multiple network services into one wholesale contract while partners own billing, support, and customer relationships

Plan to handle Tier-1 incident response; AT&T expects partners to field the first call before escalating to its NOC.

Best fit: MSPs and integrators that need secure global roaming, IoT SIM control via Cisco Control Center, and headroom to upsell fiber or edge compute alongside 5G mobility.

TD SYNNEX reported $58.5 billion in fiscal 2024 revenue and channels that scale into telecom through ConnectSolv, its connectivity marketplace. One agreement lets you quote major U.S. 5G carriers, international IoT SIMs, POTS-replacement lines, hardware, and other value-add tech solutions from the same workspace.

TD SYNNEX ConnectSolv Connectivity Marketplace Screenshot

The new PartnerFirst portal, rolled out to North American partners in September 2025, unifies quoting, activations, and commission tracking in one dashboard. Solution consultants listed on the ConnectSolv site can help you shape offers for healthcare, smart factories, or retail deployments.

Pricing is straightforward but not rock bottom; aggregator fees sit on top of carrier wholesale rates, so ultra-thin bids may feel tight. Coverage outside North America relies on roaming partners, which can add latency or limit SLA options.

Best fit: IT resellers that want to add 5G and IoT connectivity fast without negotiating multiple carrier contracts or building their own billing stack.

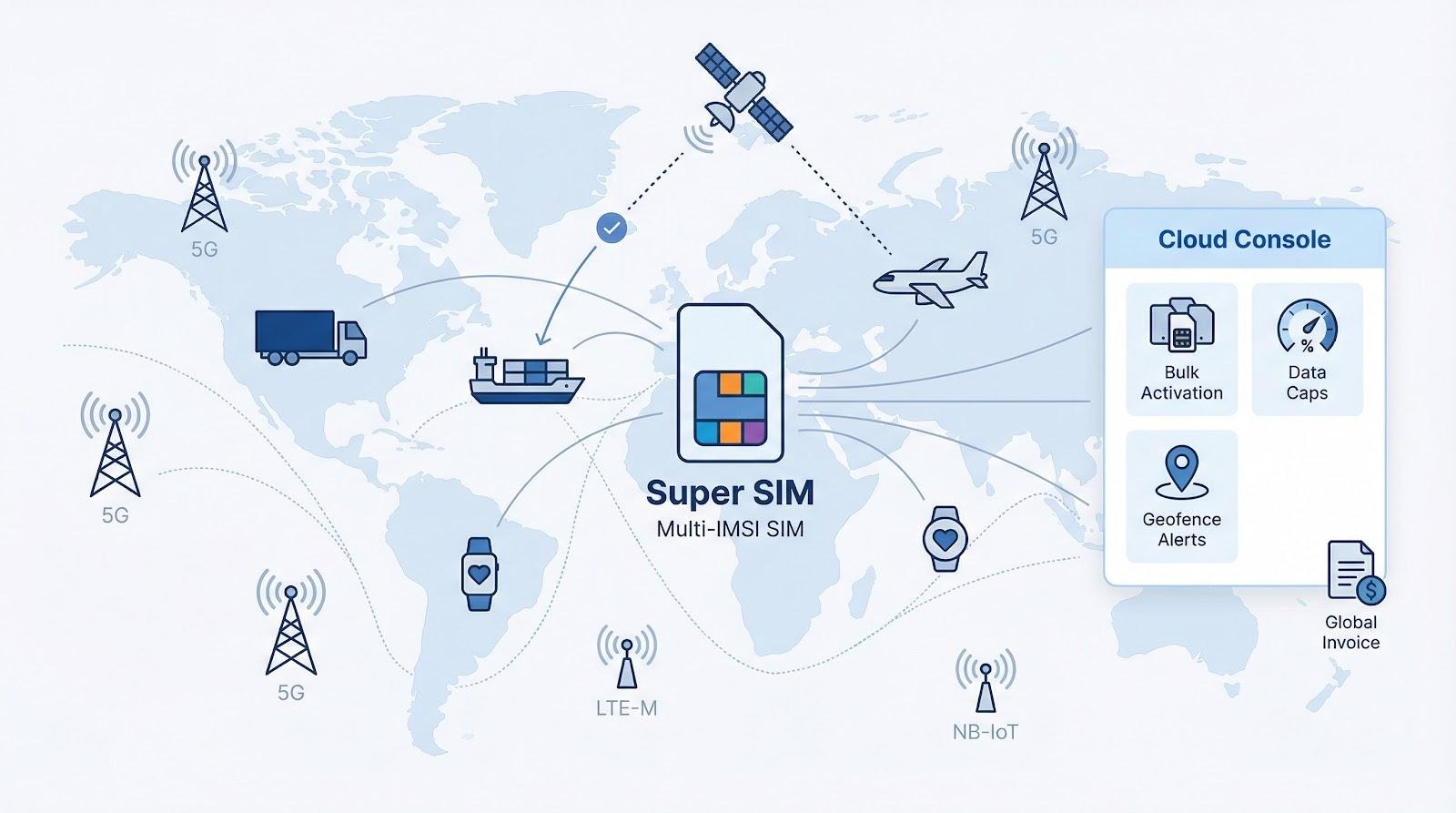

KORE powers 20 million active IoT connections across more than 400 networks in 190 countries. Its Super SIM eSIM platform and the KORE One cloud console let a single SIM hold multiple IMSIs, so devices can switch to the strongest local 5G, LTE-M, NB-IoT, or even a satellite partner without a truck roll.

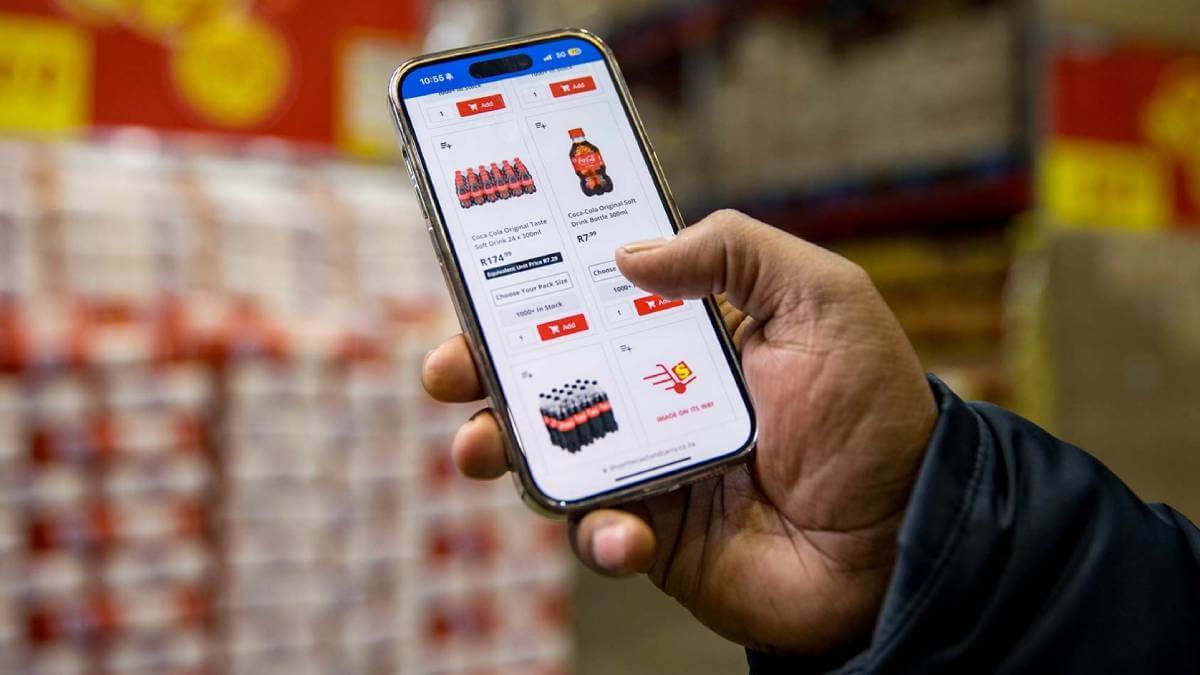

A single multi-IMSI Super SIM and cloud console let KORE-style IoT fleets switch to the strongest local network across borders

From the dashboard or REST API you can:

bulk-activate thousands of sensors,

set pooled data caps or per-device ceilings, and

trigger alerts when a tracker leaves a geofence.

Wholesale pricing is tiered by data volume rather than consumer buckets, which lets you pack connectivity into a device-as-a-service fee and grow without constant contract changes. The price per megabyte is higher than a single-carrier deal, yet you gain near-zero downtime and one global invoice.

Best fit: logistics, healthcare wearables, or any fleet that crosses borders every day and cannot risk a silent SIM. Skip KORE if you need unlimited voice plans; its stack is built for machines, not social video streams.

Orange posted €40.3 billion in 2024 revenue and serves about 300 million customers across 26 countries. For resellers, that footprint gives you wide roaming coverage plus local-market options in France, Spain, Poland, Belgium, parts of Africa, and the Middle East.

In May 2025 Orange Wholesale launched the world’s first 5G Core-as-a-Service (CNaaS), a cloud platform that lets you spin up a standalone 5G core in under an hour with pay-as-you-grow pricing. Standalone access brings lower latency today and a clear path to network slicing when your vertical apps are ready.

Commercial paths stay flexible:

sign a national MVNO deal in any Orange market, or

buy a global IoT SIM bundle that roams in more than 200 countries on pre-negotiated rates.

Plan for formal onboarding and enterprise-grade SLAs; smaller startups often enter through an Orange-approved MVNE.

Best fit: travel eSIM brands, logistics trackers, or industrial OEMs that need one SIM, one invoice, and reliable 5G performance across borders.

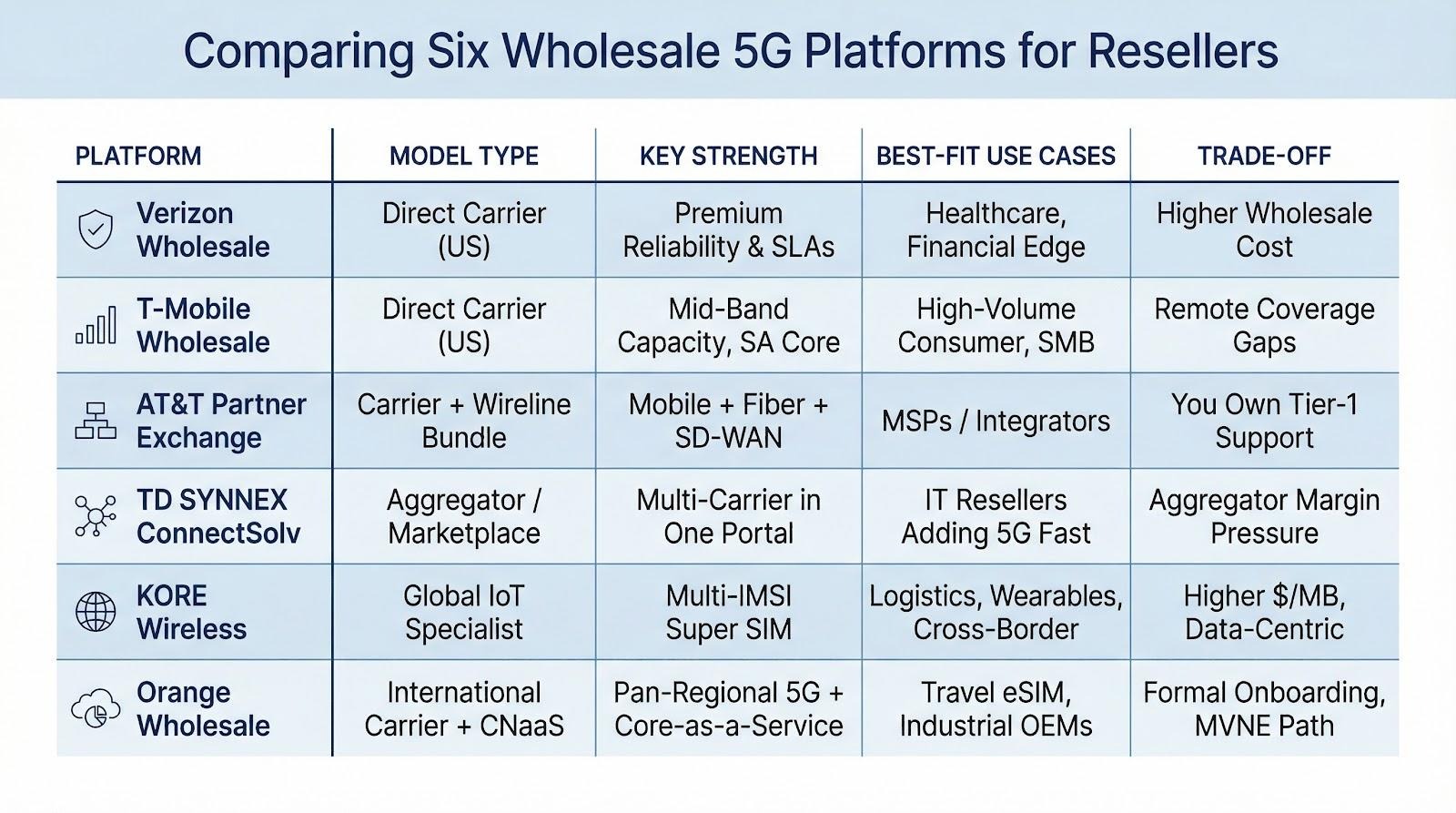

These six wholesale platforms equip telecom resellers with multiple paths to tap the growing 5G opportunity.

Side-by-side comparison of six wholesale 5G platforms helps resellers quickly match each option to their business model and target customers