NEW: BrowserGrow.com is now available!

AI agents to grow your business & do your marketing on autopilot in your browser

NEW: BrowserGrow.com is now available!

AI agents to grow your business & do your marketing on autopilot in your browser

NEW: BrowserGrow.com is now available!

AI agents to grow your business & do your marketing on autopilot in your browser

NEW: BrowserGrow.com is now available!

AI agents to grow your business & do your marketing on autopilot in your browser

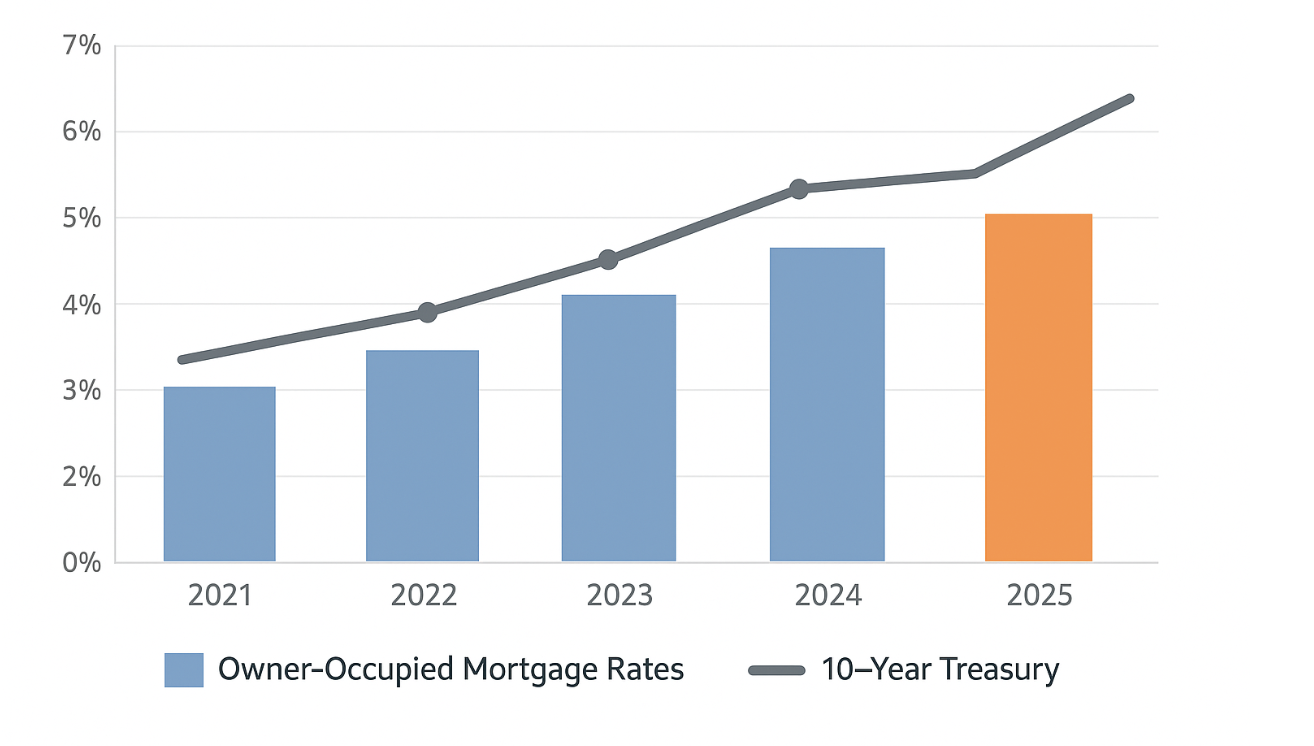

Owner-occupied rates hover near 5.4 percent (October 22, 2025)—about a point above 2021’s lows yet steady enough to move with confidence.

This guide is for you: the restaurateur craving more tables, the dentist done with rent, the warehouse operator who’s outgrowing space. Use an online loan marketplace to collect bank, SBA, and private quotes with one application even as Treasury yields climb.

Read on to match the right loan, timeline, and lender so you shift from planning to holding the keys.

Choosing a lender gets easier when you match the loan style to your build budget, cash flow, and timeline. Lendio’s commercial real estate loans marketplace, which arranges funding from $250 k to $5 million in roughly four to eight weeks, illustrates how fine-tuning amount and speed guides your drill-bit choice before you pull the trigger.

We’ll walk through each option, starting with the SBA 504—the owner-occupied program that can cover up to 90 percent of total project cost (SBA).

An SBA 504 combines a certified development company (CDC) with a bank, letting you finance up to 90 percent of total project cost (50 percent bank first lien, 40 percent CDC debenture, 10 percent equity). That can cut your cash requirement in half compared with a conventional mortgage.

The loan suits you when you will occupy at least 51 percent of the space and plan to hold the property for years. Terms run up to 25 years, and the CDC slice is fixed, keeping payments steady even if the Federal Reserve surprises the market.

Fee relief in 2025 helps: the SBA dropped its ongoing annual charge to about 0.21 percent and its upfront guaranty fee to 0.50 percent; qualified manufacturers pay zero on both, according to the SBA.

Plan for 60–75 days from signed term sheet to close to allow for the appraisal, Phase I environmental, and CDC approval. If that window works, you lock steady payments, a lower down payment, and more working capital for growth.

Think of a 7(a) loan as a single line item that covers real estate, working capital, equipment, and furniture, up to 5 million dollars per borrower, according to the SBA. That flexibility helps when your deal is smaller than the SBA 504 minimum or when you want to bundle leasehold improvements with operating cash in one note.

You typically bring 10 percent down, the same equity many 504 deals need, but repayment on real estate can run up to 25 years. Most lenders quote variable rates at Prime plus 1–3 points, below the SBA’s October 2025 ceiling of Prime plus 3 points for loans over 350,000 dollars, according to NerdWallet. Because the rate can float, you can prepay without steep penalties once cash flow improves.

Underwriters look at global cash flow, so your business and personal returns matter as much as property income. Preferred Lenders often close a 7(a) in 45–60 days when financials are clean and the appraisal arrives early, NerdWallet reports. When speed meets versatility, the 7(a) can grow with you; you avoid switching financing tools mid-project.

A conventional bank mortgage feels familiar because it works much like a home loan. Bring 20–30 percent down, keep a 1.25× debt-service-coverage ratio (DSCR), and the bank records a first lien on the property. With clean financials, many relationship banks issue a term sheet in five to seven days and can close 20–30 days sooner than typical SBA timelines.

The trade-off is leverage. Since Basel III “endgame” talks gained momentum in 2024, lenders often cap commercial loan-to-value at about 70 percent and add tighter covenants to protect capital. Strong borrowers still secure fixed rates within 75–150 basis points of Prime, but thinner margins may call for a hybrid structure or a larger equity check.

Choose a conventional note when speed and an existing banking relationship matter more than maximum leverage; the direct path from application to ownership can offset a slightly larger cash contribution.

Time can dictate the deal. A balloon matures next month, a seller cuts the price for a 10-day close, or construction delays threaten contingencies. When every day costs money, nonbank and bridge lenders step in.

Because debt funds set rates in real time, they can issue a term sheet in 48 hours and wire funds within three weeks when title is clear and your exit plan is sound. Current quotes run about 9 to 11 percent, floating, with 65–70 percent loan-to-value and interest-only payments during year one, according to Select Commercial.

You pay that higher rate for breathing room, then refinance into an SBA or bank loan once cash flow steadies, improvements finish, or seasoning milestones pass. Bridge lenders underwrite current collateral value, not last year’s tax returns, so a clear exit matters.

Expect higher fees, tighter default clauses, and personal guarantees. Choose this option when closing speed outweighs cost; the temporary bridge keeps operations running while you arrange permanent financing.

Once you know the loan options, match them to three real world factors: cash on hand, closing clock, and risk comfort. A marketplace aggregator can handle that sorting; Lendio, which analyzed more than 14 000 borrower profiles and connected them to over 75 lenders in Q2 2025, typically surfaces several offers within one business day. lendio.com+1 The table below serves the same compass because rates shift each week, but the ranges and trade offs remain consistent.

| Lender type | Max LTV | DSCR target | Typical rate band* | Closing speed | Sweet spot |

| CDC + bank (SBA 504) | up to 90 percent | 1.20–1.25× | 5.4 percent–7.0 percent | 60–75 days | Long-term control, lower equity |

| Bank conventional | 70–80 percent | at least 1.25× | 6.0 percent–7.8 percent | 30–45 days | Speed when books are clean |

| SBA 7(a) | up to 90 percent | 1.15–1.25× | Prime plus 1–3 points | 45–60 days | Smaller, multipurpose projects |

| Marketplace aggregator | mirrors lender mix | mirrors DSCR | 5.4 percent–12 percent | 30–60 days | One application, many offers |

| Private / bridge | 65–70 percent | collateral-first | 9 percent–12 percent | 10–21 days | Fast fixes, transitional deals |

*Rate references: NerdWallet CRE rate tracker (owner-occupied loans) and Select Commercial bridge-loan index, both updated October 2025.

Apply this quick filter:

Need keys in less than 45 days? Choose a private bridge or a bank that controls its own appraisal queue.

Have under 20 percent equity? Start with SBA options.

Show at least 1.30× DSCR and a clean Phase I? Conventional banks respond quickly.

Spend five minutes on this check and you can avoid weeks of dead-end calls, keeping your energy on growth rather than paperwork.

Stubborn inflation of 3.8 percent, tougher Basel III capital rules, and roughly 200 billion dollars in small-balance balloons maturing this year have reshaped every term sheet.

Commercial-mortgage pricing rides two rails: Treasury yield and perceived risk. The ten-year Treasury averaged 4.6 percent in October 2025, and lenders added 150–300 basis-point spreads, putting owner-occupied quotes in the 5.4–7.2 percent range. SBA 504 debentures priced at 5.3 percent the same month, while bridge loans cleared 9 percent.

Repayment structures have shortened as well. Before 2022 many banks wrote ten-year balloons on twenty-five-year amortizations; today they prefer five-year resets to hedge against rate swings. Private lenders like Achieve often keep the first year interest-only to smooth cash flow during renovations or tenant turnover.

Focus on the spread, not just the headline yield. Saving 25 basis points on margin lasts longer than a brief dip in Treasuries. Stress-test payments at plus 100 basis points so your pro forma can absorb the next Federal Reserve move.

Banks entered 2025 facing Basel III “endgame” proposals that raise risk weights on commercial mortgages by 20 to 40 percentage points, prompting tighter capital use. You experience that squeeze through lower loan-to-value caps, around 65–70 percent, full recourse, and “springing” covenants that hike payments when ratios slip.

Private debt funds stepped into the gap. Seeking yield, they may stretch to 75 percent loan-to-value or ease covenants, but they charge 200–300 basis points above bank rates; Blackstone’s new eight-billion-dollar real-estate debt fund targets loans in the 9 percent range.

Play it two ways:

Strong DSCR and liquidity? Collect a bank term sheet, then shop it with a private lender to gain negotiating power.

Cash flow still seasoning? Take a short bridge, stabilize income, then refinance into a bank loan once the numbers meet their targets.

Either path keeps you in control by treating lenders as resources, not gatekeepers.

About 200 billion dollars in small-balance commercial mortgages mature over the next twelve months, many on five-year balloons signed in 2020. That volume pushes every lender into triage.

Start early. Begin six months before maturity, gather trailing-twelve-month financials, order an appraisal, and confirm your Phase I environmental is still valid. A complete file rises in a crowded queue.

If turbulence seems likely, secure a fallback now. A short bridge or an SBA 7(a) refinance can cover gaps while you rebuild DSCR. Wait until the final sixty days and choices shrink while penalty fees grow.

Pull your note tonight, circle balloon dates, prepay windows, and extension fees. Finishing the handoff ten days before the due date keeps you in the driver’s seat, not the courier.

Start with the SBA 504 playbook: a CDC-and-bank combo can finance up to 90 percent of purchase or construction cost and fixes the CDC slice for twenty-five years, keeping cash free for inventory, staff, and marketing.

Closing speed depends on assembling your team early. Secure a local CDC, bring in an architect who knows the 504 draw schedule, and order the appraisal the same week you sign the letter of intent. These steps can cut the timeline to about sixty days instead of ninety.

Need heavy equipment or tenant finishes beyond the 504 scope? Add an SBA 7(a) for gear or improvements so walls and equipment sit under one capital plan, sparing you from juggling multiple maturities.

Treat a looming balloon like a fresh purchase, and run a two-track plan.

Track 1: renew with your relationship bank. Keep at least a 1.25× DSCR and stable values, then request a renewal quote six months before maturity. Provide updated tax returns, rent rolls, and a short note on any revenue dips; a complete file often secures a term sheet in about two weeks.

Track 2: lock a safety bridge. A six- to twelve-month interest-only loan buys time to finish tenant improvements or season leases. The rate is higher, yet it protects equity you could lose in a forced sale. Arrange it early so you can pivot if the bank hesitates.

Whichever path you take, schedule closing at least ten days before the balloon date. Wire delays, busy title offices, and slow payoff statements can derail a last-minute handoff, and you stay in control by finishing early.

Predictable cash flow makes medical and professional condos attractive to lenders. Many banks run doctor-loan programs that offer up to 100 percent financing for established practitioners and twenty-five-year, fully amortizing terms, with closings in about forty-five days, according to NerdWallet. Buying the suite locks your occupancy cost and adds a balance-sheet asset.

Newer practices or heavy build-outs can choose an SBA 504: include dental chairs, X-ray machines, and cabinetry in the project budget while putting down as little as ten percent. Remember the fifty-one percent occupancy rule—occupy more than half the square footage or the project is treated as an investment property and the loan-to-value limit falls.

Either path replaces unpredictable rent hikes with steady equity growth that supports your long-term plan.

Forklifts do not wait for paperwork. When orders surge and racking hits the ceiling, you need floor space quickly. Community banks that know local freight routes, zoning, and slab specs often lend up to 75 percent of cost on a conventional note, closing in about thirty days if the Phase I environmental is clear.

Appraisal timing is the hurdle. Industrial comparables can be sparse, trimming valuations and borrowing capacity. Order the appraisal the week you sign the purchase agreement, then attach rent rolls or customer contracts to prove demand; each document you supply removes days from underwriting.

Need additional power or new docks? Add an SBA 504 second lien behind the bank’s first. You keep cash in the business and lock a fixed rate on the improvement slice, avoiding future payment shocks when you install the next conveyor line.

For multi-site operators or those assembling adjacent parcels, understanding how a blanket mortgage works can simplify financing by consolidating properties under one note with potential partial-release clauses, supporting phased expansion without multiple closings.

Expansion should feel like progress, not delay. Choose a lender that respects your production calendar so forklifts stay moving rather than sitting idle, and take your small business to new heights.

Underwriting answers one question: Will the loan repay on time? Lenders pull three levers you can adjust before the file leaves your desk.

Debt-service-coverage ratio (DSCR). A 1.25× DSCR means net operating income covers annual debt service with 25 percent left over. Banks rarely dip below this mark, while SBA programs may accept about 1.15×. Recast your profit and loss to remove one-time expenses and owner perks; every recovered dollar lifts DSCR.

Loan-to-value (LTV). Conventional terms top out near 75 percent LTV under 2025 capital rules, while an SBA 504 can reach 90 percent if the appraisal supports it. Provide recent capital improvements or signed leases to defend value when comparables run thin.

Global cash flow. Privately held companies are reviewed at the owner level. Lenders combine business and personal returns to confirm that total income covers total debt. Pay down high-interest cards or equipment notes before submitting to improve this ratio.

Once the numbers clear, the clock starts:

Weeks 1–2 – issue term sheet, post deposit, order third-party reports

Weeks 3–6 – receive appraisal, environmental assessment, and title work

Weeks 7–9 – finalize credit, draft legal documents, schedule closing

Missing documents or surprise liens can add weeks. Send a complete package on day one to keep the timeline tight.

Review prepayment language as well. Conventional notes often carry yield-maintenance fees, while SBA 504 debentures use a declining premium that falls to zero after year ten. Knowing the exit cost upfront lets you model the loan’s true life-cycle price and avoid expensive surprises later.

Two term sheets can look identical until the fine print adds thousands of dollars. We break them down the same way we price new equipment.

Start with annual percentage rate (APR), which folds the note rate and all lender fees into one number. Example: a one-million-dollar loan at 5.75 percent with a two-percent origination fee pushes APR to about 6.2 percent, while a six-percent note with a half-percent fee lands near 6.1 percent, cheaper despite the higher headline rate.

Next, weigh amortization versus term. A twenty-five-year amortization on a five-year balloon keeps payments low but forces a refinance sooner. A fully amortizing note costs a little more each month yet removes balloon risk; match the structure to your growth horizon, not today’s spreadsheet comfort.

Now review the soft costs. Packaging, appraisal, environmental, legal, and third-party review fees vary widely. Ask each lender for a closing-cost worksheet and place the line items side by side; the exercise often trims a few thousand dollars and reveals who values transparency.

Finally, plug each offer into a commercial-loan calculator, such as NerdWallet’s, and stress-test payments at plus 100 basis points above the quote. The option that keeps cash flow comfortable under that bump protects your future.

How much do I need to put down?

Conventional lenders usually want 20 to 30 percent equity. SBA 504 and 7(a) programs can lower the requirement to 10 percent if the appraisal supports value and you occupy at least 51 percent of the space.

What credit score gets me in the door?

Most banks and SBA lenders look for a personal FICO of at least 680. Private lenders focus on collateral and exit strategy; deals can close with lower scores, but rates and fees rise.

How long will closing take?

With a clean file, conventional loans often close in 30 to 45 days; SBA 504 averages 60 to 75 days; private bridge capital can fund in about 14 days.

Do I need to worry about prepayment penalties?

Yes. Bank notes often carry yield-maintenance or step-down penalties for the first three to five years. SBA 504 debentures use a declining premium that falls to zero after year ten. Always read this clause before signing.

What costs hit at closing besides the rate?

Plan for appraisal, environmental report, title insurance, lender legal, and origination or packaging fees. A practical cushion is 1 to 3 percent of the loan amount; then negotiate any line that feels padded.