NEW: BrowserGrow.com is now available!

AI agents to grow your business & do your marketing on autopilot in your browser

NEW: BrowserGrow.com is now available!

AI agents to grow your business & do your marketing on autopilot in your browser

NEW: BrowserGrow.com is now available!

AI agents to grow your business & do your marketing on autopilot in your browser

NEW: BrowserGrow.com is now available!

AI agents to grow your business & do your marketing on autopilot in your browser

What makes an investment truly successful — instinct or information?

Data has quickly become the foundation of smarter decision-making in the investment world. As technology continues to evolve, relying only on gut feelings or traditional methods isn’t enough anymore.

Investors are now turning to AI-driven analytics, real-time market insights, automated platforms, and blockchain solutions to uncover opportunities, manage risks, and boost returns.

This article explores how technology is shaping investment strategies and driving growth.

For hedge funds like Quant Edge, data has transformed investing into a space where decisions are smarter, faster, and more precise — enabling managers to analyse markets in real time, test strategies rigorously, and respond quickly to shifting economic conditions. In the past, investors often relied heavily on market intuition, historical patterns, or lengthy research reports. However, today, they have access to real-time data and advanced analytics that redefine the way opportunities are identified and risks are managed.

The power of data lies in its ability to uncover insights that may otherwise remain hidden. For instance, predictive analytics can highlight emerging market trends, while alternative data, such as consumer behavior, social sentiment, or supply chain activity, offers unique perspectives beyond traditional financial statements.

Open-ended questions allow respondents to answer in their own words, without having to be limited to any response options, aka multiple choice questions. This gives respondents freedom to express their thoughts, opinions, and feelings about details they need to choose.

Open-end questions need to be asked when you are doing the following:

Trying to learn more on what customers think about your brand

Figuring out what demands of the customer aren’t met

Exploring which factors influence the decision-making process

Understanding how customers describe your product on a deeper level

Learning the pain points of your audience and what it actually uses.

If you want to know how to ask open ended questions properly, you need to know which are the right ones to ask. In Attest’s guide, they explain that open-ended questions are ones that:

“allow respondents to answer in their own words, in a free-form answer, without being limited to predefined response options, aka multiple choice questions.”

Here are some good examples we can give you from our side:

General feedback questions: What motivated you to choose us over the right? How would you describe your experience with us in your own words?

Investment/ private equity context: What qualities do you value most in a private equity partner? What challenges do you face most often when evaluating new investment opportunities?

Customer experience: What improvements would you like to see in our platform or services? If you could change one thing about our service, what would it be and why?

Future-oriented: Where do you see the biggest opportunities for growth in your industry? What trends do you believe will most influence your investment decisions over the next five years?

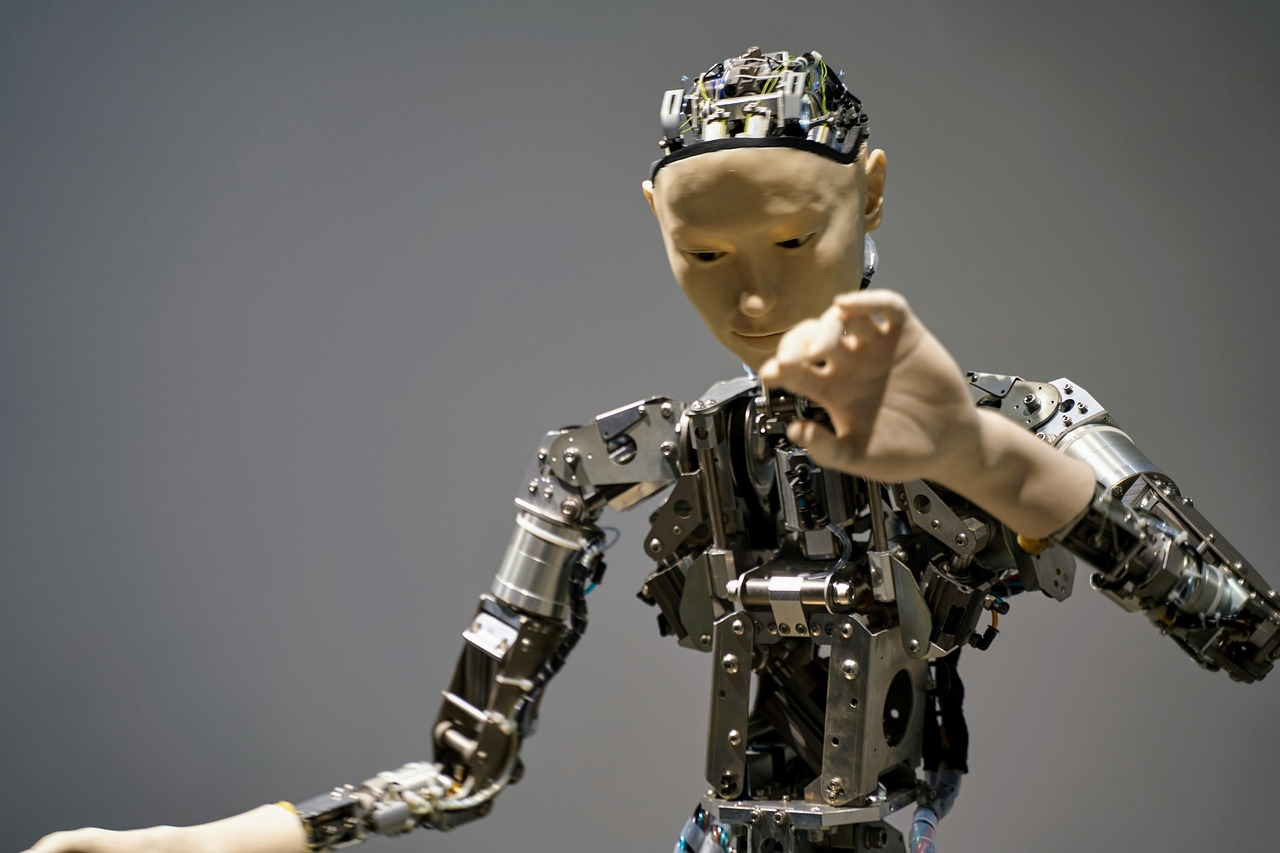

Artificial Intelligence (AI) and Machine Learning (ML) are reshaping the investment landscape by turning large amounts of complex data into insights that can help investors. Traditional analysis methods are limited in speed and scope, but AI and ML algorithms can process massive datasets in real time, scanning company performance and market trends.

Machine Learning (ML), in particular, excels at recognizing patterns that humans may overlook. For example, it can detect subtle correlations in stock movements, predict credit risks, or forecast market volatility with higher accuracy. AI-driven tools also support portfolio optimization by automatically balancing assets to minimize risk while maximizing returns.

Beyond that, natural language processing (NLP) can analyze news articles and social media chatter to gauge market moods, giving investors an edge.

In private equity, relationships are the foundation of every successful deal. Managing investors, tracking portfolio companies, and keeping up with countless touchpoints requires more than spreadsheets or generic tools; it calls for a specialized CRM. A private equity CRM streamlines deal flow, centralizes communications, and provides real-time insights that help firms act faster and smarter.

Looking at Meridian Private Equity and its approach shows how technology can turn relationship management into a competitive advantage. By bringing complex data and interactions together in one place, a private equity CRM ensures no opportunity is overlooked and every connection is nurtured.

As the industry becomes more data-driven, the right CRM is essential. This way, investors can scale easily and create a more professional and powerful network, helping them make better decisions. At this stage, many private equity firms adopt a dedicated Private Equity CRM to unify deal flow, relationship intelligence, and portfolio oversight in one system. Here’s a practical overview of how a Private Equity CRM supports sourcing, execution, and long-term relationship management.

Real-time tools and automation are redefining how investors operate, making the decision-making process much faster and more efficient. We have to be honest, the world nowadays is changing every day, and access to live data is a necessity.

Automation takes this step further by getting rid of repetitive tasks and streamlining workflows. From automated deal sourcing and due diligence to portfolio monitoring and reporting, technology reduces manual effort and increases accuracy. In fact, 50% of work today is automatable.

The combination of real-time tools and automation empowers investors to move with agility. Instead of being bogged down by data entry or delayed updates, they can focus on strategic decisions that drive growth. Ultimately, the integration of speed, precision, and efficiency creates a sharper competitive edge.

Cybersecurity and data protection have become non-negotiable priorities. Investors and private equity firms handle highly sensitive information, from financial records and investor details to deal documents and portfolio company data. Any breach or mishandling not only risks financial loss but can also severely damage trust and reputation.

Powerful cybersecurity measures, such as encryption, multi-factor authentication, and secure cloud environments, make sure that confidential data remains protected at every stage of the investment process.

Data protection regulations, including GDPR and CCPA, further emphasize the need for firms to handle information responsibly, with clear policies on collection, storage, and access.

Real-time cybersecurity tools can detect suspicious activity, while automation helps reduce human error. Statistics show that 95% of data breaches are due to human error!

That being said, strong cybersecurity and data protection measures aren’t only able to minimize risks, but can help build investor confidence and protect business relationships.

Success is no longer driven by instinct alone, nor is it achieved purely through automation. The most powerful strategies emerge where human expertise meets technology.

While advanced tools such as AI, machine learning, and real-time analytics can process large amounts of information and highlight opportunities, it’s human judgment that provides context, intuition, and strategic foresight.

For instance, data-driven platforms can identify promising deals, but experienced investors are the ones who evaluate what’s good for them in the long term. Similarly, automation may streamline workflows, yet it’s human relationships and negotiation skills that ultimately close a deal.

By blending the precision of technology with the insight of human decision-making, investors gain a more complete picture, balancing speed and accuracy with experience and vision. This partnership doesn’t replace people; it amplifies their capabilities, allowing firms to move faster while maintaining the wisdom that comes only from expertise.

The future of investing is being shaped by technology at a pace unlike ever before. As markets grow more complex and global, traditional methods alone can’t keep up with the volume and speed of information. Therefore, tech-driven investing is paving the way for strategies that are faster, smarter, and more precise, offering investors a competitive edge.

AI and ML will continue to evolve, allowing predictive models that anticipate market movements and uncover hidden opportunities. Automation will streamline back-office operations, freeing up time for strategic decision-making, while real-time data tools will empower investors to act instantly in volatile conditions.

As for institutional investors and private equity, the integration of technology into CRM systems, deal sourcing, and portfolio monitoring will be key to scaling effectively. The firms that embrace these innovations won’t only minimize risks but also unlock new pathways for growth.

The evolution of investing is powered by data, automation, and advanced technologies such as AI and ML. Real-time insights, secure platforms, and smarter tools are giving investors the ability to act with greater speed and precision than ever before.

Yet, even as technology drives efficiency and opens new opportunities, it’s human expertise that proves judgment, strategy, and relationships necessary to turn potential into performance.

The future of investing will not be defined by choosing people or technology, but by how effectively the two work together. Firms that embrace innovation while preserving the values of human insight will also be best positioned to manage risks, build trust, and achieve sustainable growth.